Vanguard Economics (VE) is working to better understand how and why businesses based in Rwanda export their goods, and through the data analysed, develop a framework for this activity.

We have found the ‘how and why’ is answered by two key factors: 1) a firm’s interest in exporting; and 2) a firm’s propensity for risk.

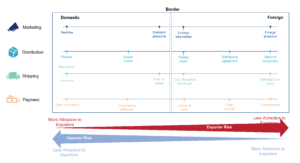

Once the above is identified, there are four primary variables that an exporting business considers:

1. Market Identification – How are goods and services produced in/by a country identified by potential buyers in export markets? Firms’ response to this can range from (1) reactive – waiting for buyers to find them, and (2) proactive – going out to find buyers.

2. Distribution – Through which paths are goods reaching the end consumer? Paths include the following:

- The shop floor.

- Export houses. Exporters produce and sell to aggregators who then manage the export process.

- Foreign distributors. Exporters have distribution agreements with foreign distributors.

- Direct sales. Exporters sell directly to consumers in foreign markets through a local presence.

3. Shipping – What is the shipping arrangement? The shipping arrangement not only covers how the goods are physically moved but also the point of transfer of ownership of the goods from a Rwandan firm to the international buyer (if any). There are five common approaches in shipping. These are:

- Firms that do not take any risk in moving goods and are collected in Rwanda by a buyer.

- Firms that clear goods for export, move them and transfer the ownership at the departure port.

- Firms that deliver goods to the destination port with the cost of the goods, insurance, & freight covered.

- Firms that deliver goods to the agreed place in the foreign market.

4. Payment – How is payment processed? The choice of payment modality has major implications on cash flow, risk, and ultimately the success of any export endeavour. Payment technicalities required by firms range from pay being required before the transfer of ownership to the buyer, cash in advance, and firms that request payment once the goods are received by the end consumer.

Fig. 1 Image depicting a potential path to market within a framework

Historically, the variables involved in identifying and acting upon export opportunities have been separate entities rather than parts of a whole.

Our analysis suggests that for Rwandan firms to successfully export their products, a framework as illustrated above in Fig. 1, is needed.

With this new understanding, we believe that trade policies and export promotion initiatives can be better designed to address exporters’ realities. We also believe our analysis can be used to educate firms on export approaches, what options are available to them, and what this implies when it comes to their competitiveness in the foreign market.

Written by Christian Shema Berwa

Edited by Yvonne Mwiza